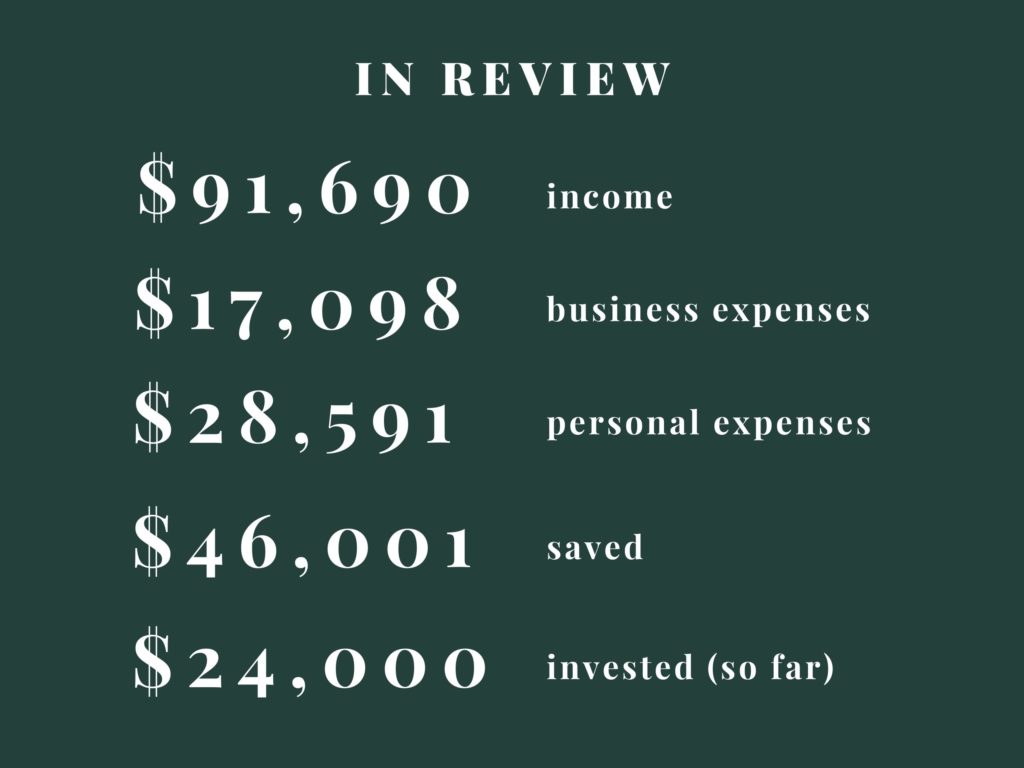

I thought the perfect subject for my very first blog post would be an intimate introduction into my own financial situation – a Becker Talks Money 2021 Numbers in Review! I truly believe creative entrepreneurs should be sharing more about how much money we make and spend.

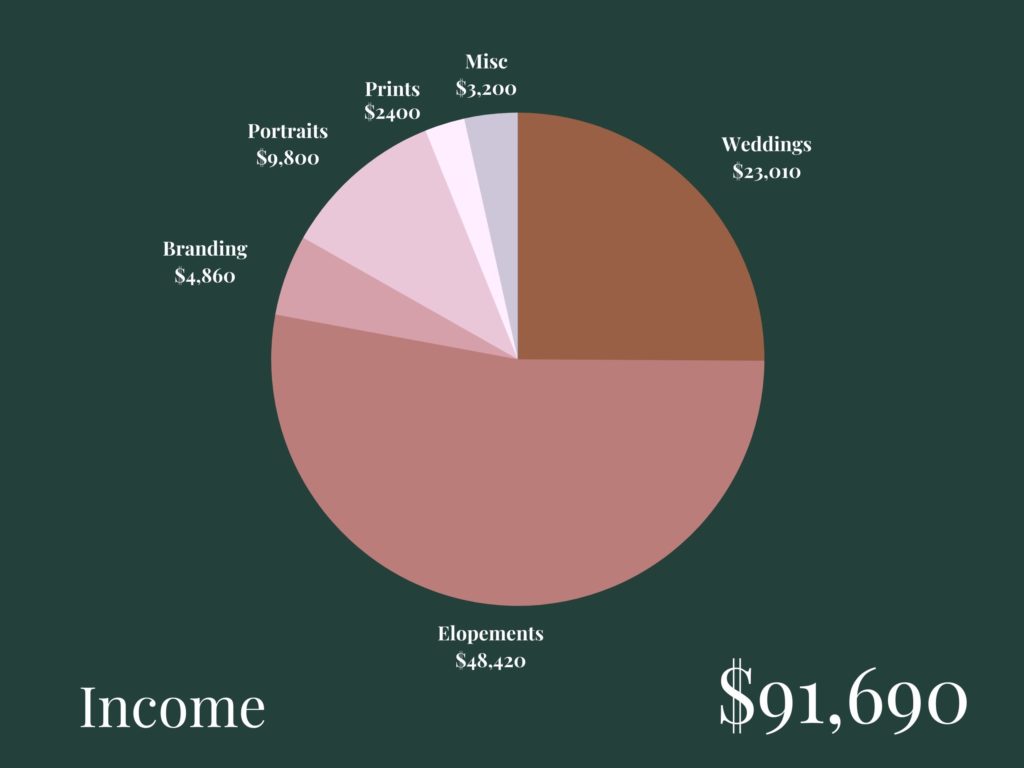

When people learn how much money I save and invest in a year, they typically assume I’m making over six figures (or even multiple six figures). My income goal for 2021 was $70,000 (my “enough” number – more on that in a later blog post) and I clocked in at $91,690.

I track my income and expenses constantly throughout the year, and I had way too much fun making these pie charts from my customized spreadsheet. (I’m the nerd that emails my CPA before Christmas – I know, I know.)

I was really tickled to see elopements making up over 50% of my income (52.8%, in fact). When I first started shooting elopements, so many people commented how they aren’t money makers and that’s why many photographers don’t photograph them at all. I’ve had the opposite experience and it’s truly been so nice to connect with so many couples wanting to get married no matter what. Branding is typically a larger percentage, but has really slowed down in the pandemic when so many businesses are struggling.

You don’t see real estate in my income for two reasons:

- The commercial space I co-own didn’t do any owner payouts in 2021 (we actually haven’t done owner payouts since our very first year open, 2017). Real estate is a long game.

- The income from the residential homes I own with my partner and manage go into his account (I can definitely talk more about this if people want to know!).

A few notes on my personal expenses:

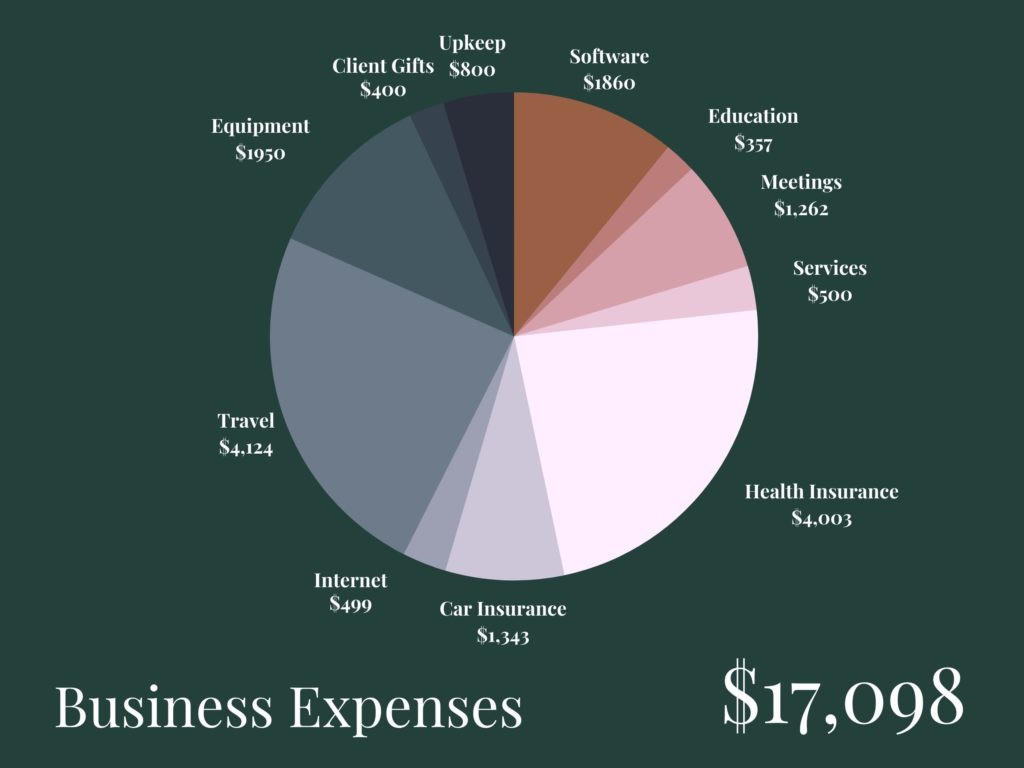

- I was shocked by how much software cost me in 2021! None of these are things I can really skimp on – things like my website, my gallery hosting (nearly $500 a year just for that), client management software, editing software, etc. This is just an expense I am always going to incur at SBP.

- Same goes for “upkeep” – things like insurance, professional dues, etc.

- Health insurance is such a huge expense. I was very grateful to get a grant for the last two months of the year, but before that my monthly premium is $470.

A few notes on my personal expenses:

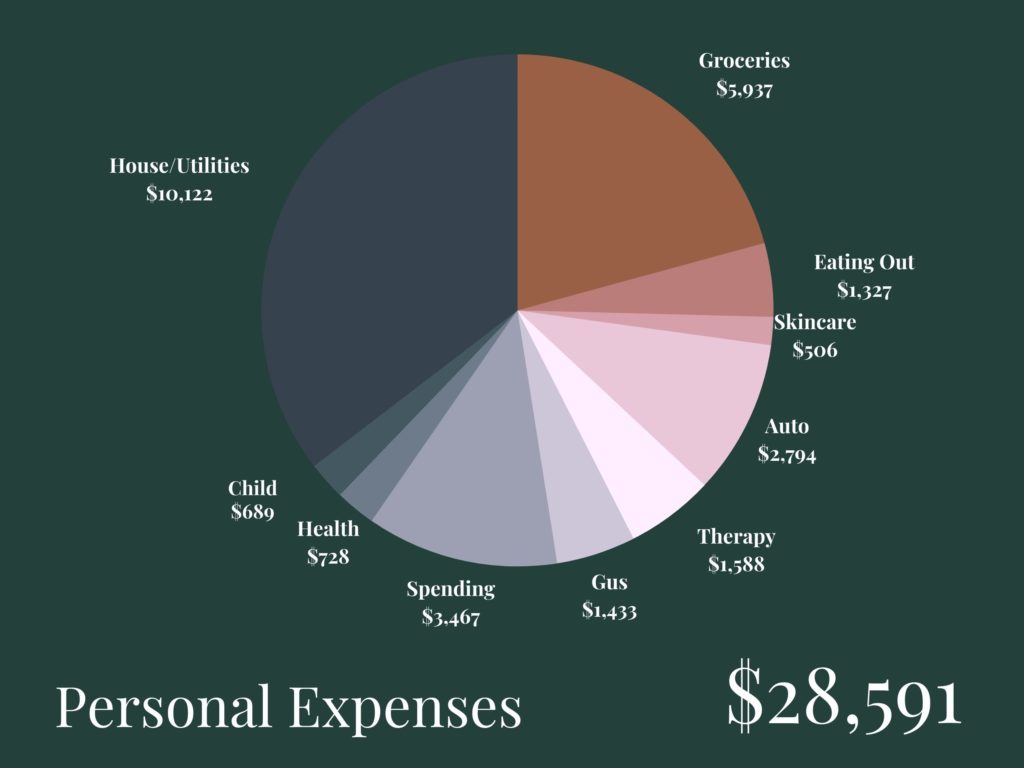

- I got into skincare in 2020, and wanted to track how much I was spending specifically on that in 2021 – over $500! Yikes! I’ll say it is/was definitely a hobby, and I spent 2021 trying a lot of different things out I was able to pass on to friends if I didn’t keep. I’m expecting to spend less than half of this in 2022.

- My child spending is low because my partner handles the largest expenses, and I typically buy his clothes/some experiences/fun things/presents and toys for holidays and birthdays.

- Groceries is clearly a large part of this pie, but not one I plan to change. We do not eat out a lot, and the grocery store is really the only place I let myself get whatever I want. This number is for 2 adults and a child half the time.

- In 2022 I plan to break out the “spending” category into several more specific sub-categories – in 2021 this encapsulated home goods and needs (for two homes), clothing (although looking back I bought more clothing for my kiddo and partner than for me this year!), thrifting, and the dreaded Amazon purchases.

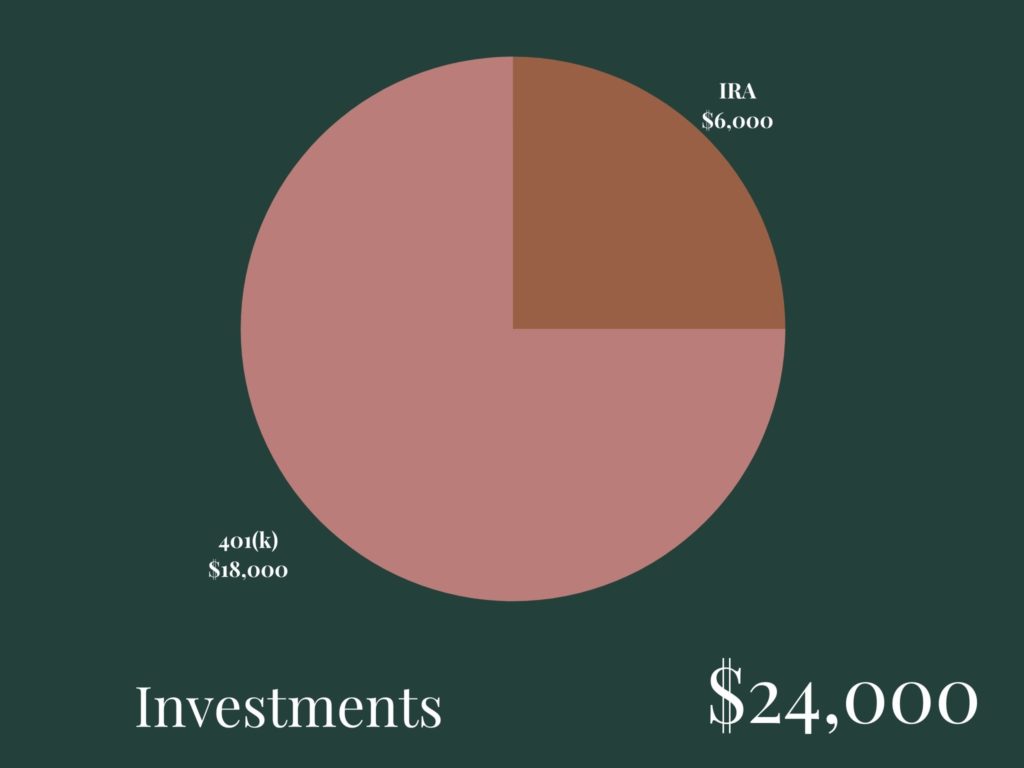

I maxed out both my Roth and 401(k) from the personal end at $24,000 total. Once I go through my taxes and ascertain my net income as well as my tax liability, I’ll be able to add to the 401(k) and my brokerage.

Any questions about my 2021 Numbers in review?! Do you know yours?

[…] enough number = $70,000. In 2021 I made a little over $90,000 so was able to save even […]

[…] In 2021 I made a little over $90,000 so was able to save and invest even more. […]